Are Electronic Signatures Legally Binding? A Complete Guide

Are electronic signatures legally binding? Our guide explains the ESIGN Act, eIDAS, and key security practices that make your e-signatures enforceable.

Yes, in the vast majority of developed countries, electronic signatures are legally binding. Key legislation in places like the United States and the European Union has made it clear: an electronic signature carries the same legal weight as its traditional, pen-and-ink counterpart.

This legal acceptance is the engine that keeps modern business moving.

Why Digital Agreements Are Legally Enforceable

Think about a simple handshake deal. In theory, it’s a valid contract. But in practice, proving it in court can be a nightmare. Who said what? When did they actually agree? It all comes down to memory and good faith, which is a shaky foundation for any important agreement.

Electronic signature laws were designed to solve this exact problem for our digital interactions. They establish a clear, reliable framework for capturing and proving agreement without ever touching a piece of paper. A legally sound e-signature isn't just a picture of your name; it’s the result of a secure process that creates a verifiable record of the entire signing event.

The Foundation of Trust in E-Signatures

At its heart, a signature is just a symbol. It represents a person's intent to agree to the terms laid out in a document. The law has evolved to recognize that this intent can be shown just as clearly with a click of a mouse as it can with the stroke of a pen.

The big legal shift wasn't really about the technology. It was about confirming that the intent to sign is what truly matters, no matter the medium. This core idea is what makes digital contracts stand up in court.

This isn't a new concept, either. For over 20 years, foundational laws have provided the groundwork for secure digital business. They established a simple but powerful rule: no contract can be thrown out just because it’s in an electronic format. If you want to dive deeper into the specifics, our guide on what makes an electronic signature legally compliant has all the details.

Key Legal Frameworks for Electronic Signatures at a Glance

A few landmark laws form the bedrock of e-signature validity around the world. Here’s a quick look at the major players that ensure your digital agreements are enforceable.

| Legal Act | Jurisdiction | Core Principle |

|---|---|---|

| ESIGN Act | United States (Federal) | Gives electronic signatures the same legal status as handwritten signatures across the country. |

| UETA | United States (State) | Creates a consistent legal model for electronic transactions, adopted by nearly every state. |

| eIDAS | European Union | Establishes a single, unified standard for electronic identification and trust services for all EU members. |

These regulations provide the certainty and predictability businesses need to operate confidently without paper.

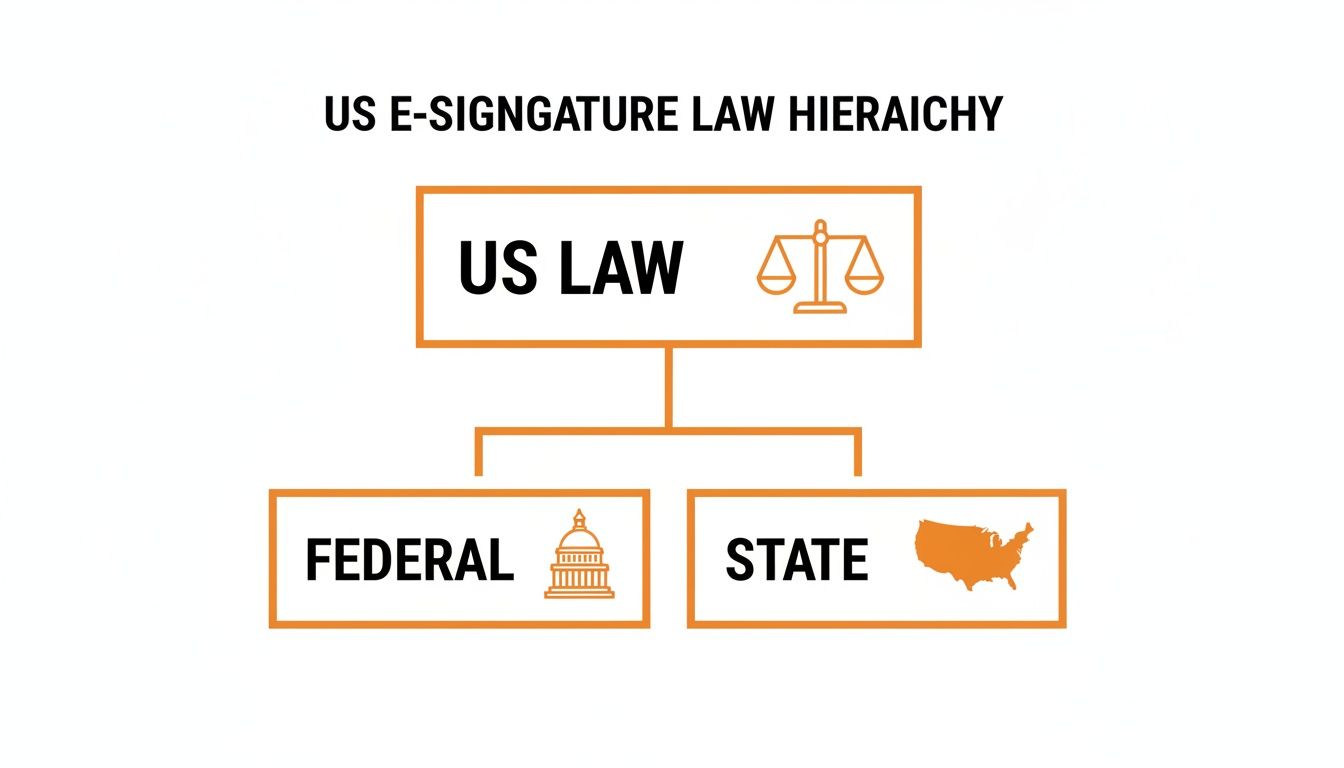

The Legal Foundation for E-Signatures in the US

In the United States, the question of whether electronic signatures are legally binding is answered by a powerful partnership between federal and state laws. This framework doesn't just allow for e-signatures; it actively protects their validity, giving them the same legal punch as a traditional wet ink signature.

The cornerstone at the national level is the Electronic Signatures in Global and National Commerce Act (ESIGN Act), which became law back in 2000. Think of the ESIGN Act as a national guarantee. It sets a clear, country-wide rule: no signature, contract, or record can be thrown out simply because it's electronic.

This federal law provides the big-picture principle, creating a predictable legal environment for business that crosses state lines or even international borders. It’s what ensures a contract signed electronically between a company in California and a client in New York is just as solid as one signed in the same room.

UETA: The State-Level Rulebook

While the ESIGN Act sets the national standard, the Uniform Electronic Transactions Act (UETA) gets into the nitty-gritty at the state level. Drafted in 1999, UETA was designed to sync up state laws on electronic dealings, creating a more consistent experience across the country.

This two-layer system works like a charm. The ESIGN Act acts as the federal safety net, while UETA is the specific playbook most states follow. Thanks to the ESIGN Act, e-signatures have clear federal standing, but it's the widespread adoption of UETA—now active in 49 states, the District of Columbia, and U.S. territories—that truly harmonizes the rules. Discover more insights about the legal landscape for electronic signatures on pdffiller.com.

This broad acceptance means the core rules for what makes an e-signature legally sound are remarkably similar whether you're doing business in Florida, Texas, or Washington.

Key Requirements for a Valid E-Signature

Both the ESIGN Act and UETA boil down to a few key criteria that an electronic signing process must meet. These aren't just technical checkboxes; they're the pillars that prove a signature is both authentic and intentional.

To make sure your e-signature can stand up to scrutiny, you have to be able to prove:

Clear Intent to Sign: The signer has to take a deliberate action—like clicking a button, typing their name, or drawing their signature—that shows they meant to sign. The interface has to make it obvious that their action will create a binding signature.

Consent to Conduct Business Electronically: Before anyone signs, all parties have to agree to use electronic documents and signatures. This is usually handled with a clear disclosure statement that a user must accept before moving forward.

Association of Signature with the Record: The e-signature must be logically and securely connected to the document it belongs to. A signature file floating on its own is meaningless; it has to be an inseparable part of the final, signed record.

A legally sound e-signature is more than just an image on a screen. It's a verifiable process that captures the signer's clear intent and links it permanently to a specific document, creating a record that is difficult to dispute.

Modern platforms like QuickSign are built from the ground up to handle these requirements automatically. They guide everyone through a compliant process, making sure every signature is captured with the necessary intent, consent, and association.

The Power of the Audit Trail

Maybe the most critical piece of the puzzle in proving an e-signature's validity is the audit trail. This is a comprehensive, time-stamped log that captures every single action taken on a document from start to finish.

A strong audit trail records crucial data points, such as:

- The email addresses of every participant.

- The exact date and time the document was sent, viewed, and signed.

- The IP address from each signer's device.

- A record of when consent to do business electronically was given.

This detailed log provides powerful, court-admissible evidence that can prove who signed, when they signed, and that the document hasn’t been tampered with since. This is especially vital for complex agreements or those that might require notarization. As regulations evolve, staying on top of topics like nationwide standards for remote and electronic notarization is key to ensuring compliance.

Ultimately, the audit log is what transforms an e-signature from a simple action into a secure, verifiable, and legally defensible event.

How the EU Regulates E-Signatures with eIDAS

While the United States uses a dual federal-state system, the European Union took a much different, more unified approach. To make electronic signatures legally binding across the continent, the EU built a single framework that applies to all 27 member states. This master plan removes legal headaches and makes cross-border business a whole lot smoother.

This powerful regulation is called eIDAS, which stands for Electronic Identification, Authentication and Trust Services. Rolled out in 2016, eIDAS created a clear, tiered system for e-signatures, so everyone from Dublin to Warsaw knows exactly how different digital signatures are treated in the eyes of the law.

Think of the eIDAS framework as a pyramid. Each level up adds more security and legal weight, giving businesses the freedom to choose the right tool for the job. It's all about balancing convenience with the level of risk you're willing to take on.

The Three Tiers of eIDAS Signatures

The eIDAS Regulation breaks down electronic signatures into three distinct types. Getting a handle on these is crucial for anyone doing business in the EU's single market.

Simple Electronic Signature (SES): This is the most basic form you'll encounter. It can be anything from typing your name at the bottom of an email to clicking an "I Agree" button online. It signals your intent, but it's light on security.

Advanced Electronic Signature (AES): Here, things get more serious. An AES has to be uniquely linked to the person signing, able to identify them, and created using data that only they control. Crucially, it must be tied to the document in a way that shows if anyone has tampered with it after the fact.

Qualified Electronic Signature (QES): This is the top of the pyramid—the digital gold standard. A QES is a more secure version of an AES, created with a special device and backed by a qualified certificate from a government-approved trust service provider.

This structure ensures that as the stakes get higher, the signature's integrity and legal standing rise to meet them.

Comparing EU Electronic Signature Types Under eIDAS

To make sense of these tiers, it helps to see them side-by-side. The following table breaks down the key differences in requirements, use cases, and legal power, showing how each signature type is designed for a different purpose.

| Signature Type | Key Requirements | Common Use Cases | Legal Weight |

|---|---|---|---|

| Simple (SES) | Basic electronic data showing intent (e.g., a checkbox, typed name). | HR forms, website terms of service, internal approvals. | Admissible in court but may require supporting evidence. |

| Advanced (AES) | Uniquely linked to the signer, capable of identifying them, and tamper-evident. | Sales contracts, employment agreements, B2B deals. | Strong legal standing; considered reliable and evidentially sound. |

| Qualified (QES) | AES created with a qualified device and certificate from a trusted provider. | Real estate sales, high-value loans, official court filings. | Legally equivalent to a handwritten signature across all EU member states. |

Ultimately, the eIDAS framework gives businesses a clear roadmap for choosing the right signature type, ensuring their agreements are both practical and legally sound.

Why a Qualified E-Signature Is a Game Changer

The real knockout punch in the EU's system is the legal status of the top tier. Under eIDAS, a QES has the exact same legal effect as a traditional handwritten signature across all 27 EU countries. No ifs, ands, or buts. This gives it the strongest possible legal footing in any courtroom.

That automatic legal equivalence is a massive deal. It means a contract signed with a QES can't be challenged just because it's digital; it is legally presumed to be authentic and valid from the get-go.

For this reason, a QES is often mandatory for high-stakes agreements like real estate deals, major corporate filings, and any document that traditionally required notarization. The technical rules are strict, and businesses need to stay current as the EU continues to refine its standards. It's always a good idea to understand how the EU tightens rules for Advanced Electronic Signatures under eIDAS to remain compliant.

Practical Applications of Each Signature Type

The beauty of the eIDAS system lies in its flexibility. You don’t need to bring out the big guns (a QES) for every single agreement. Smart businesses match the signature type to the level of risk involved.

Here’s how it usually plays out in the real world:

Simple Electronic Signature (SES): Perfect for low-risk, everyday agreements. Think signing up for a newsletter, accepting website cookies, or giving a thumbs-up to an internal company policy.

Advanced Electronic Signature (AES): The go-to for more substantial business contracts where you need to be sure who signed. This includes things like employment offers, important sales agreements, and partnership deals.

Qualified Electronic Signature (QES): Reserved for the most critical documents that absolutely cannot be questioned. We're talking cross-border property sales, multi-million-euro loan agreements, or any other transaction where legal challenges are a serious risk.

Platforms like QuickSign are built from the ground up with eIDAS compliance in mind, offering the robust security features and detailed audit logs needed to back up the legal validity of your signatures, particularly at the Advanced and Qualified levels. By providing a secure and verifiable signing process, these tools give you confidence that your digital agreements will hold up under EU law.

A World That Runs on Digital Contracts

While the laws in the US and EU are major players, they're just part of a much bigger story. The question "are electronic signatures legally binding?" is now met with a firm "yes" almost everywhere you look. What felt like a niche tech a decade ago is now the bedrock of global business.

This didn't happen by accident. It's the result of a deliberate, worldwide legal shift, with many countries taking their cues from the UNCITRAL Model Law on Electronic Commerce. Think of it as a blueprint from the United Nations that helped nations build their own e-signature laws on a common foundation, making digital trade far more predictable and reliable.

This legal evolution has gone hand-in-hand with an explosion in economic activity, proving just how vital e-signatures have become. The numbers don't lie—this technology is no longer a novelty; it's a necessity.

The Data Behind the Digital Boom

The global embrace of electronic signatures isn't just a legal footnote; it’s a massive economic force. More than 90 countries now have modern e-commerce or e-signature laws, and every single G20 nation recognizes their validity in some form. This widespread legal backing has opened the floodgates for incredible growth.

For instance, the number of global e-signature transactions shot up from around 89 million to 754 million in just five years during the early 2020s. That’s a clear sign of how deeply businesses have woven digital signing into their day-to-day operations. The market value naturally followed, growing from $2.8 billion in 2020 to a projected $9.85 billion by 2025.

These aren't just abstract figures. They represent businesses closing deals faster, hiring talent across continents, and managing contracts more securely than ever before.

The rapid, worldwide adoption of e-signature laws is the clearest signal you can get: digital is the new default. Countries that were once paper-and-ink economies have actively built legal systems to support a faster, more efficient digital way of doing business.

This global consensus makes international business far less risky. Whether you're finalizing a sales contract with a partner in Japan, hiring a contractor in Brazil, or securing funding from investors in the UK, you can move forward with confidence, knowing the electronic agreements holding it all together are legally solid.

The Foundation of Modern Global Business

Ultimately, the shift to digital contracts is about more than just convenience. It's about achieving the speed and scale today's economy demands. Paper-based workflows are full of friction—they cause delays and create security gaps that simply don't fly in a competitive market.

Secure, verifiable, and legally recognized e-signature platforms have become essential tools. They help companies everywhere:

- Speed Up Sales: Close deals in hours instead of weeks by getting rid of the print-sign-scan-mail routine.

- Work More Efficiently: Streamline everything from HR onboarding to internal approvals and compliance paperwork.

- Improve Security: Create a stronger, more defensible record of an agreement with detailed audit trails and encryption—often better than paper.

- Go Global: Do business across borders without worrying if your digital contracts will hold up.

This global acceptance isn't just a passing trend; it's a fundamental change in how business gets done. For a deeper look at where things are headed, our analysis of the global digital signature market study highlights just how much growth is still to come. The message is clear: e-signatures are a core part of modern commerce.

Ensuring Your Electronic Signature Is Enforceable

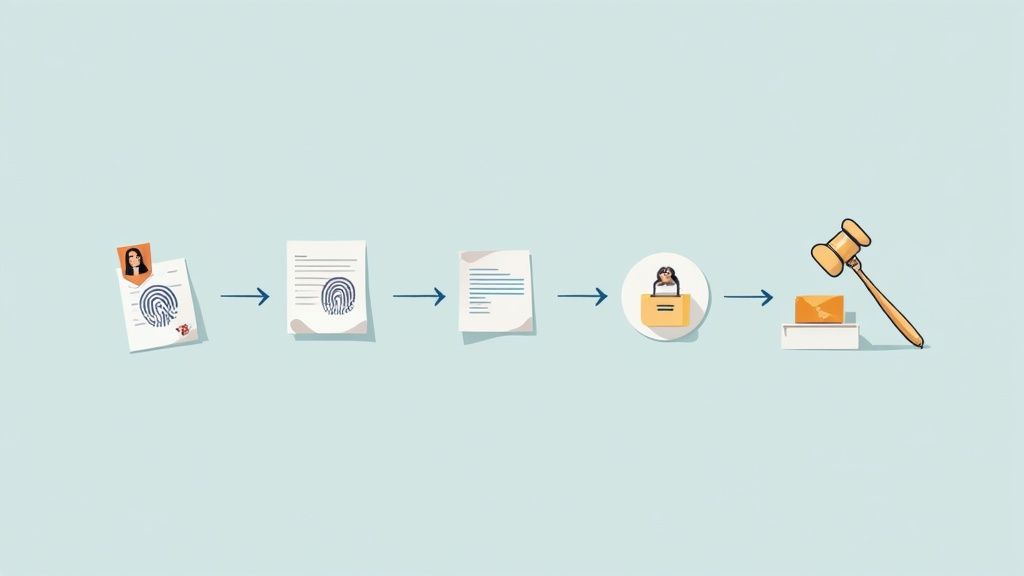

Knowing an e-signature is legally binding in theory is one thing. Proving it in a dispute is a whole different ball game. So, how do you turn a simple click into a legally defensible action? It all boils down to the evidence you can bring to the table.

Think of it like building a case for court. The signature itself is just one exhibit. To make it stick, you need to surround it with a solid foundation of proof. Without it, even a perfectly valid signature can crumble under scrutiny.

The Three Pillars of Enforceability

For an electronic signature to be truly enforceable, your process needs to definitively answer three critical questions: Who actually signed this? Can you prove they meant to sign it? And is the document exactly the same as it was at the moment of signing?

This is where the three pillars of enforceability come in.

Robust Signer Authentication: You need a reliable method to confirm the signer is who they say they are. This could be a basic email verification, or it could be something much stronger like two-factor authentication. The goal is to tie the signature to a specific person.

Complete Data Integrity: The signed document must be tamper-evident. The best e-signature platforms use cryptographic hashing to "seal" the document upon signing. This creates a digital fingerprint, and if even a single comma is changed later, that seal is broken and the change is immediately obvious.

A Comprehensive Audit Trail: This is your secret weapon. The audit trail is a detailed, time-stamped log that records every single interaction with the document. It’s the story of the signing process, and it’s powerful, court-admissible evidence.

When you combine strong authentication, a tamper-proof document, and a detailed log, an e-signature transforms from a simple mark into a secure, verifiable, and legally binding event.

The Power of a Detailed Audit Trail

While authentication and integrity are crucial, the audit trail is the glue that holds it all together. It's the step-by-step narrative, capturing everything from the moment a document is sent to the final signature. A strong audit log is your best defense.

An audit trail transforms a signature from a static image into a dynamic, verifiable story. It provides the context, timing, and digital fingerprints necessary to prove intent and authenticity beyond a reasonable doubt.

Modern e-signature platforms are built to do this heavy lifting for you. Every view, every click, and every signature is automatically recorded, creating a complete history you can rely on if a contract is ever questioned.

A solid audit trail should always include:

- Document History: Timestamps showing when the document was created, sent, viewed by each person, and signed.

- Recipient Information: The full name and email address of everyone involved.

- IP Addresses: The IP address from which each person signed, which helps confirm their location.

- Authentication Records: A log of exactly how each signer’s identity was verified.

This level of detail makes it incredibly difficult for someone to later claim they never saw the document or didn't agree to its terms. To dive deeper into how these safeguards work, our guide on secure document signing breaks down these protective measures.

With a platform like QuickSign, this rock-solid evidence is automatically generated for every agreement, giving you confidence that your contracts will hold up.

Common Exceptions Where E-Signatures Aren't the Answer

So, are electronic signatures always legally binding? For most business deals, absolutely. But it’s not a blanket rule. Think of e-signatures as the express train for getting agreements done—they handle the vast majority of commercial traffic quickly and efficiently. A few special documents, however, still have to take the old-fashioned, pen-and-paper local route.

These exceptions are few and far between, but you need to know what they are. They typically involve life-changing events where the law requires a more formal, deliberate ceremony to make sure everyone is on the same page and to protect against pressure or fraud. Knowing where the line is drawn helps you use e-signatures confidently for everything else.

Documents That Still Need a Wet Signature

Even with powerful laws like the ESIGN Act making e-signatures the norm, some documents are specifically excluded. The common thread among them is their profound personal and legal weight. In these cases, the physical act of signing adds an undeniable layer of intent and seriousness.

Here are the key areas where you'll almost certainly still need a pen:

- Wills and Testamentary Trusts: When it comes to directing where your assets go after you’re gone, the law demands the formality of a physical signature, usually with witnesses present.

- Family Law Documents: Things like adoption papers, divorce decrees, and other sensitive family court agreements are typically kept out of the e-signature realm.

- Official Court Orders and Notices: You can't e-sign your way out of certain legal notices. Court orders, utility shut-off notices, and foreclosure or eviction notices often must be delivered on paper.

- Key Life Certificates: Government-issued records that mark major life events—think birth certificates, death certificates, and marriage licenses—are still firmly in the world of traditional signatures.

It's worth repeating: these are the outliers. Their existence doesn't change the fact that e-signatures are legally solid for the 99% of business, sales, and HR contracts you'll encounter.

Why Do These Exceptions Even Exist?

It all comes down to certainty and protection. For something as final as a will or as sensitive as an adoption, the law puts a premium on preventing any hint of coercion or fraud. The physical ceremony of signing in front of witnesses creates a powerful, indisputable record of a person’s intent.

That said, the ground is slowly shifting. Some states are beginning to explore electronic notarization and signing for documents like real estate deeds. But for now, the golden rule is to always check your local regulations for these high-stakes documents. By knowing the specific carve-outs, you can move forward and digitize the vast majority of your agreements with complete peace of mind.

Your Top Questions About E-Signature Legality, Answered

Once you get past the big picture, the nitty-gritty details of e-signature law can feel a little fuzzy. While it’s true that electronic signatures are broadly accepted as legally binding, knowing the finer points will give you the confidence to use them correctly and sidestep common mistakes.

Let’s clear up some of the most common questions we hear.

Is a Typed Name in an Email Legally Binding?

Surprisingly, yes—sometimes. Laws like the ESIGN Act care most about the signer's intent. If you type your name at the bottom of an email to show you agree to the terms you just discussed, that action can be enough to create a binding contract.

But here’s the catch: it's an incredibly weak form of signature. It has none of the security, verification, or detailed audit trail you’d get from a proper e-signature platform. If you ever ended up in a legal dispute, proving who actually typed that name and what their intent was would be a tough, uphill battle.

What's the Real Difference Between Electronic and Digital Signatures?

People often use these terms as if they mean the same thing, but there's a crucial difference. It helps to think of it like this: "electronic signature" is the general legal idea, while "digital signature" is the specific technology used to create a super-secure version of one.

Electronic Signature: This is the big umbrella term. Legally, it's any electronic sound, symbol, or process that shows someone intended to sign something. That includes everything from a typed name to clicking an "I Agree" button.

Digital Signature: This is a very specific type of electronic signature. It relies on sophisticated cryptography to create a unique digital "fingerprint" that gets locked into the document. This provides powerful proof of who signed it and confirms the document hasn't been tampered with since.

So, while every digital signature is an electronic signature, most electronic signatures are not digital signatures.

Do I Have to Use Special Software for My E-Signature to Be Legal?

No, the law doesn't name-drop any specific software. The legal focus is always on whether you’ve met the core requirements: intent, consent, and a solid record of the transaction.

However, choosing not to use a reputable e-signature provider is a huge risk.

A simple typed signature might pass the legal test on a good day, but it’s a featherweight in court compared to a signature created through a compliant platform. Professional software is purpose-built to give you the rock-solid evidence you'd need if things go sideways.

Platforms like QuickSign are designed from the ground up to meet these legal standards. They automatically handle the tricky parts, like identity verification, tamper-sealing the final document, and creating a detailed audit log that tracks every single action. That built-in compliance is precisely why they’re essential for any serious business.

Ready to create legally binding signatures with confidence? QuickSign provides end-to-end encryption, detailed audit logs, and full eIDAS compliance to ensure your agreements are secure and enforceable. Get your documents signed in minutes by trying QuickSign today.