A Guide to Legal Requirements for Electronic Signatures

Understand the legal requirements for electronic signatures. Our guide covers ESIGN, UETA, and eIDAS to ensure your e-signatures are compliant and enforceable.

Yes, electronic signatures are legally binding—they carry the same legal weight as a handwritten signature, but only if they check a few critical boxes. For an e-signature to hold up, you have to be able to prove who signed the document, that they fully intended to sign it, and that the document hasn't been touched since.

What Makes an E-Signature Legally Binding

Think about how you'd prove a traditional "wet ink" signature is real. You might call on a witness or even bring in a handwriting expert. Electronic signatures do the same thing, just digitally. They rely on a detailed "audit trail"—a court-admissible record that captures every step of the signing ceremony.

This isn't some new, untested idea. Landmark laws like the U.S. Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA) were put in place way back in 2000. These acts were game-changers, officially giving electronic signatures the same legal footing as their pen-and-paper counterparts.

Since then, they've become an everyday part of business. By the mid-2020s, a staggering 75% of U.S. businesses were regularly using e-signatures for their contracts. Industries like law, finance, and real estate, where paperwork is king, were among the first to fully embrace them. You can discover more insights about e-signature adoption trends on textcontrol.com.

Core Principles for Legal Validity

So, what are the non-negotiables that make an e-signature legally sound? No matter which law you're looking at, it all boils down to a few core ideas.

To make this crystal clear, here’s a quick breakdown of the fundamental principles every enforceable e-signature must satisfy.

Fundamental Principles of a Legally Binding E-Signature

| Legal Principle | What It Means in Plain English | Why It Matters for Compliance |

|---|---|---|

| Intent & Consent | The person signing must clearly show they meant to sign and agreed to do business digitally. | This is usually captured with an "I agree" checkbox or clear disclosure language. Without it, a signature can be challenged as accidental or coerced. |

| Authentication & Attribution | You need a reliable method to verify the signer's identity and prove it was them who applied the signature. | This could be an email verification, a unique access code, or other identity checks. It connects the digital mark to a real person. |

| Record Integrity | The final, signed document must be locked down and tamper-evident. Any changes made after signing must be detectable. | Secure, unalterable records (like a sealed PDF) are crucial. This ensures the agreement a person signed is the same one presented in court. |

These three pillars work together to create a trustworthy and legally defensible record of the agreement.

The goal of any compliant e-signature process is to create a comprehensive, tamper-proof record that can definitively answer three questions: Who signed? Did they mean to sign? And is this the exact document they signed?

This gives you the foundational knowledge of what makes an e-signature valid. For a deeper dive into the specifics, you can also learn more about legally binding electronic signatures in our detailed guide. Now, let’s look at the major laws that put these principles into practice.

The 3 Core Tests for a Legally Binding E-Signature

When you get down to it, every legally sound electronic signature has to pass three fundamental tests. I like to think of them as the legs of a stool—if one is wobbly or missing, the whole thing comes crashing down the moment it's challenged in court.

Getting these right isn't just about ticking a legal box; it’s about creating a signing process you can actually stand behind. These aren't just abstract theories—they're practical hurdles every signature must clear to be considered valid. Let's walk through each one.

Test 1: Intent to Sign

First and foremost, you have to prove intent. A signature, whether it’s made with a pen or a click, is a symbol. It’s the outward sign of someone's deliberate decision to agree to something. The law demands clear proof that the person meant to bind themselves to the contract.

Think about signing a lease with a pen. The physical act of picking it up and forming your name is a clear, conscious action. The digital world needs an equivalent.

This is usually accomplished by having the person take a clear, affirmative step, like:

- Clicking a button that says "I Agree" or "Accept and Sign."

- Typing their name into a clearly marked signature field.

- Drawing their signature on a screen with their finger or a mouse.

The action has to be unmistakable. An accidental click somewhere on the page won't cut it. A good e-signature platform is designed to capture this very moment, providing a clear record that the user took a specific, deliberate action to apply their signature.

Test 2: Consent to Do Business Electronically

Next up is consent. Just because someone is willing to sign a document doesn’t automatically mean they’ve agreed to handle the entire process online. Major laws like the U.S. ESIGN Act require all parties to positively agree to use digital records and signatures instead of paper.

This is like the digital handshake before you even get to the signing part. It’s a moment where everyone agrees to proceed in a paperless way.

You can't just assume consent; you have to get it explicitly. This is usually done with a clear disclosure statement before the document is even shown. The signer typically has to check a box or click "Agree," confirming they're okay with conducting the transaction electronically.

For instance, you might see a pop-up that says, "By continuing, you agree to receive and sign these documents electronically." It’s a simple step, but it’s crucial. It prevents anyone from later claiming they were pushed into a digital process they didn't understand or want. It also covers other details, like letting them know they have the right to request a paper copy.

Test 3: A Clear Record and Association

The final test is all about the integrity of the record. This is a two-part challenge. First, you need to prove the signature is securely linked to the specific document it was meant for. Second, you have to show that the document hasn't been secretly changed or tampered with since it was signed.

Think of it like a tamper-evident seal on a medicine bottle. If that seal is broken, you immediately know something’s wrong. E-signature platforms create a cryptographic "seal" on the document the instant it's signed, locking it down.

The secret weapon here is a comprehensive audit trail. This is the digital evidence locker that captures every single thing that happened with that document. It’s a detailed, time-stamped log showing:

- When the document was created and who it was sent to.

- The email and IP address of the person who opened it.

- The exact time they viewed the document.

- A record of every click, including the consent to do business electronically and the final signature.

This audit trail creates a rock-solid chain of custody, linking the signer’s actions to the exact version of the document they signed. If there’s ever a dispute, this record provides powerful, court-admissible evidence that the signature is genuine and the contract is exactly as it was when they signed it.

3. Navigating E-Signature Laws in the US and EU

While the core tests for a valid e-signature are pretty consistent across the globe, the legal frameworks that bring them to life can be worlds apart. If you’re doing business internationally, understanding the key differences between the major legal systems—specifically in the United States and the European Union—isn't just a good idea. It's essential.

Think of it like driving. The basic principles of stopping at a red light and staying in your lane are universal. But one country drives on the right side of the road with signs in miles per hour, while another drives on the left using kilometers. Both systems work, but you absolutely need to know the specific rules of the road you're on to avoid a major problem.

The US Approach: ESIGN and UETA

In the United States, the legal ground rules for electronic signatures are set by two main laws: the federal ESIGN Act (Electronic Signatures in Global and National Commerce Act) and UETA (Uniform Electronic Transactions Act), which has been adopted in some form by 49 states.

These laws are built on a foundational principle called technology neutrality. This is a huge deal. It means the law doesn't care what specific technology you use. Whether it's a simple click-to-agree button, a typed name, or a sophisticated cryptographic signature, its legal validity hinges on whether it meets those core requirements we discussed: intent, consent, and record integrity.

This approach gives businesses a ton of flexibility. The focus is less on the specific tool and more on the process and the evidence it generates. Under US law, a rock-solid audit trail is your best friend—it’s the proof you’ll need to show that all the legal boxes were checked.

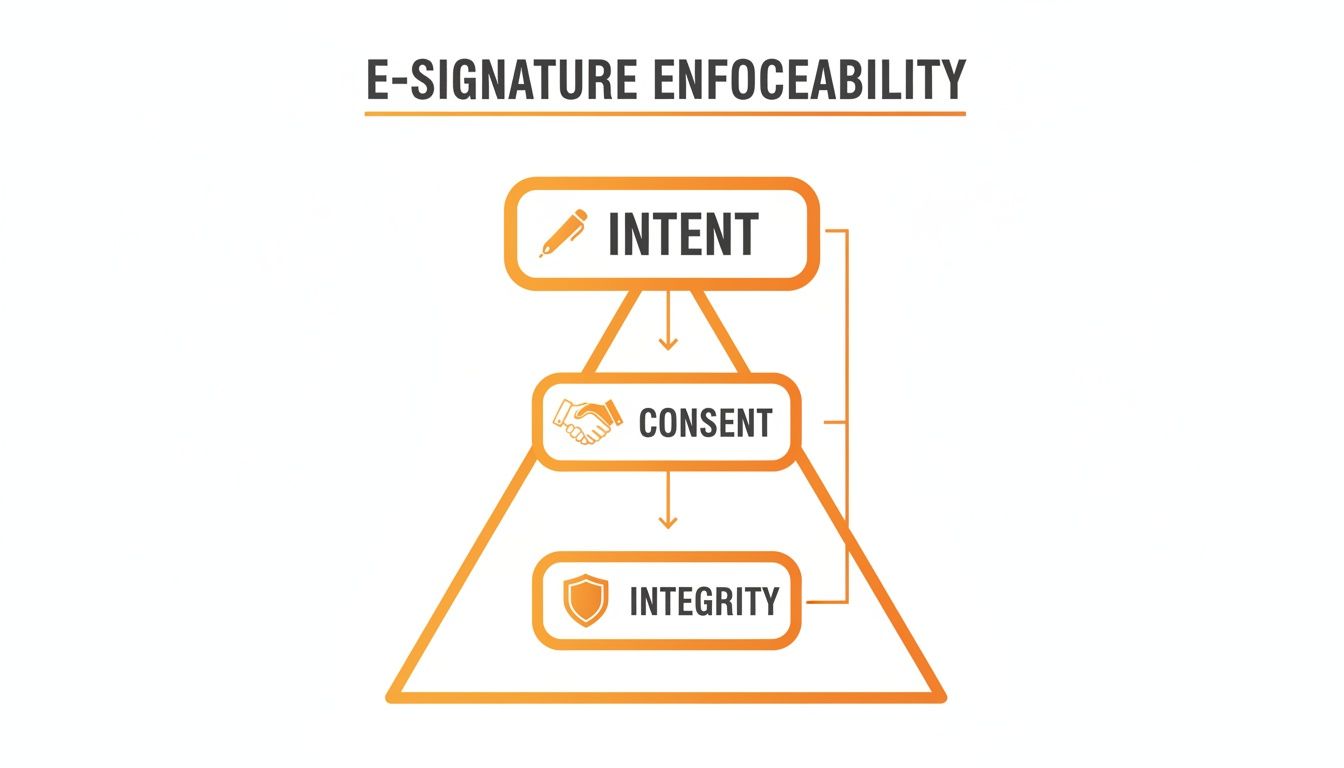

The diagram below breaks down these universal pillars that support e-signature enforceability, which are central to the US legal model.

As you can see, intent, consent, and integrity form the bedrock of a legally sound signature, a concept that US law strongly upholds.

The EU Model: A Tiered System Under eIDAS

The European Union goes in a different direction with its eIDAS Regulation (Electronic Identification, Authentication and Trust Services). Instead of the flexible, technology-neutral approach, eIDAS creates a much more structured, three-tiered hierarchy of electronic signatures. Each tier comes with increasing levels of security and, critically, a different legal weight.

If you do business in or with the EU, you need to know these tiers cold:

Standard Electronic Signature (SES): This is the most basic level and can be as simple as a scanned signature pasted into a document or clicking an "I agree" button. It’s legally recognized, but if challenged in court, its strength depends entirely on the evidence you bring to the table.

Advanced Electronic Signature (AES): This is a major step up in security. An AES has to be uniquely linked to the signer, be able to identify them, be created using data that only the signer controls, and be tied to the document in a way that shows if it's been tampered with after signing. For a deeper dive, check out our article on the technical rules for Advanced Electronic Signatures under eIDAS.

Qualified Electronic Signature (QES): This is the gold standard in the EU. A QES is basically a supercharged AES that is created using a special, secure device (a QSCD) and backed by a qualified certificate from a government-approved trust provider.

Comparing US (ESIGN/UETA) and EU (eIDAS) Regulations

The differences between the US and EU legal models aren't just academic—they have major real-world consequences for businesses. To make it clearer, here’s a side-by-side look at how the two systems stack up.

| Legal Aspect | United States (ESIGN & UETA) | European Union (eIDAS Regulation) |

|---|---|---|

| Legal Framework | Technology-neutral. The law doesn't favor any specific technology. Focus is on the process and evidence (intent, consent, record integrity). | Tiered system. Defines three specific types of e-signatures (SES, AES, QES) with different legal weights. |

| Signature Types | No formal tiers. All electronic signatures are treated equally, with validity determined by evidence like audit trails. | Three distinct tiers: Standard (SES), Advanced (AES), and Qualified (QES). |

| Legal Equivalence | A valid e-signature cannot be denied legal effect solely because it is in electronic form. The burden of proof is on the party asserting its validity. | A QES has the same legal effect as a handwritten signature by law across all 27 EU member states. This automatically shifts the burden of proof. |

| Cross-Border Recognition | Generally accepted for domestic and international business, but acceptance in other countries depends on their local laws. | QES from one EU member state must be legally recognized as a QES in all other member states, creating a unified digital market. |

| Typical Use Cases | Most commercial contracts, HR documents, sales agreements, and consumer agreements. | QES is often required or preferred for high-value or high-risk transactions like real estate deeds, court filings, and regulated financial services. |

As the table shows, the US system offers flexibility, while the EU system provides a clear, standardized path to achieving the highest level of legal certainty.

Key Takeaway: In the US, the burden is on you to prove a signature is valid, no matter the technology. In the EU, using a QES automatically gives the signature the highest legal status, shifting the burden of proof away from you.

This means you have to adapt your strategy based on who you're dealing with and what's at stake. A simple sales contract between two companies in California might be perfectly fine with a standard e-signature that has a strong audit trail. But a multi-million-dollar acquisition involving a German company? That would almost certainly call for a Qualified Electronic Signature to ensure its legal standing is ironclad across the EU.

A Look at Global E-Signature Laws

Signing agreements digitally isn't just a U.S. or European trend—it’s a global phenomenon. But while the goal is always the same (creating a legally binding agreement), the legal playbook changes from one country to the next. If you do business internationally, you have to know the local rules.

Think of it this way: the core principles we’ve covered—intent, consent, and a solid record—are like the basic recipe for a cake. But as you travel, you’ll find that each country adds its own unique ingredients, altering the final flavor. Most international laws share the same foundation, but the specific application can be quite different.

Key International E-Signature Laws

Outside of the United States, you'll often encounter a "tiered" legal model. This approach is very common and categorizes e-signatures based on their level of security and reliability. It’s not just about if a document was signed, but how it was signed.

Here are a few major examples to see how this plays out:

United Kingdom: After Brexit, the UK didn't reinvent the wheel. It essentially absorbed the EU's eIDAS regulation into its own domestic law. This means it recognizes simple, advanced, and qualified electronic signatures, which is great news for businesses needing a consistent compliance framework between UK and EU partners.

Canada: Our neighbors to the north have a federal law called PIPEDA (Personal Information Protection and Electronic Documents Act). Much like the US, Canada's approach is technology-neutral. The law focuses on the outcome: did the signature reliably identify the person and show they intended to sign?

Australia: Down under, the Electronic Transactions Act of 1999 sets the stage. It’s another technology-neutral framework, similar to the U.S. model. The key tests are whether a method was used to identify the person and indicate their approval, and if that method was reliable given the circumstances.

What's the common thread here? A worldwide agreement that electronic signatures are legit. The real differences are in the details—the specific technical requirements for proving who signed and keeping the document secure.

When dealing with international contracts, the question isn't just "Is this e-signature valid?" It's "What level of security and identity verification does this country require for this type of document?"

The Ripple Effect of Global Adoption

When countries establish clear legal frameworks for e-signatures, it pours fuel on the fire of digital commerce. We've seen it time and again: clear laws lead to faster market growth and higher transaction volumes.

India is a perfect case study. Its Information Technology Act, passed way back in 2000, helped kickstart massive digital adoption across the country. This legal clarity has been a major factor in the Asia-Pacific region's explosive growth in the e-signature market. In fact, some reports project that global e-signature transaction volumes will hit over 4.7 billion by 2025. You can find more data on the global growth of e-signature transactions on esignglobal.com.

Even countries with centuries-old legal traditions are getting on board. Switzerland, for example, has its own sophisticated framework (ZertES) that runs parallel to the EU's eIDAS standards. For a deeper dive into how these rules are evolving, check out our post on how Switzerland tightened its oversight of trust service providers.

Getting these nuances right is what allows you to sign secure, enforceable agreements—no matter where your business takes you.

When an E-Signature Is Not Legally Valid

As much as we rely on electronic signatures for countless business deals, it’s a mistake to think they’re a universal fix. Both the ESIGN Act and UETA deliberately draw a line in the sand, setting aside a handful of deeply personal or high-stakes legal documents that still demand old-fashioned ink.

Blowing past these boundaries isn't just a minor slip-up; it can render an entire agreement invalid. These exceptions aren't arbitrary. They exist to add extra safeguards in situations where the law wants to ensure no one is being pressured and that everyone understands the full weight of what they’re signing. Knowing what you can't sign electronically is every bit as important as knowing the legal requirements for electronic signatures.

Documents That Still Require a Wet Ink Signature

While the exact list can shift a bit depending on your jurisdiction, you'll find that the same types of documents pop up as exceptions again and again. These are the situations where a traditional, physical signature is often still the only way to go.

Here are some of the most common carve-outs:

- Wills, Codicils, and Testamentary Trusts: When it comes to estate planning, the law is extra cautious. The need for a physical signature, often with witnesses present, is a powerful safeguard against fraud or coercion.

- Family Law Documents: Think adoption papers, divorce decrees, or prenuptial agreements. These life-altering documents are typically excluded to ensure everyone has had proper legal counsel and formal oversight.

- Official Court Orders and Notices: Any formal document coming from the court system—like an official order, a notice of default, or foreclosure paperwork—usually has to follow traditional signing and delivery methods.

Why These Exceptions Matter

The thinking behind these exclusions is all about protecting the people involved. Take a will, for instance. The act of signing a physical document in front of witnesses creates a clear, powerful record of a person's final wishes. It’s a deliberate ceremony that a quick click just can't match.

In these specific cases, the law prioritizes ceremony and physical presence over digital convenience. The act of signing in person serves as a final, unambiguous confirmation of intent in life's most critical moments.

The same logic applies to other specialized documents, like promissory notes or checks governed by the Uniform Commercial Code (UCC), which have their own set of rules. The big takeaway here is simple: never assume an e-signature is good enough for every single document. When the stakes are high, always double-check the specific rules in your jurisdiction. It’s the only way to be sure you aren’t creating an agreement that’s unenforceable from the start.

This focus on document integrity is also a hot topic in digital security. You can learn how a new AuthSig framework targets reuse of scanned signatures to better understand the push for more secure signing methods.

Your Practical E-Signature Compliance Checklist

Knowing the legal theory is one thing, but actually putting it into practice is what keeps your business safe. A strong, defensible e-signature isn’t an accident; it's the result of a deliberate, repeatable process. This checklist breaks down the essential steps to make sure every signature you collect is secure, compliant, and ready to stand up in court.

Think of these steps as a pre-flight check for your agreements. Each one confirms that a critical piece of the legal requirements for electronic signatures is locked in before your document ever gets off the ground. By following them, you build a powerful, court-admissible record from the very start.

1. Verify Who Is Signing

Before anyone even clicks a button, you need a solid way to confirm they are who they say they are. Just sending a link to an email address isn't always enough, especially for high-stakes contracts. The goal is to create an undeniable link between the signature and a specific person.

You can seriously strengthen your identity checks with methods like these:

- Two-Factor Authentication (2FA): This is a big one. Sending a one-time code to a signer’s phone adds a crucial second layer of proof.

- Access Codes: Protect the document with a unique password that you’ve shared with the recipient separately.

- Knowledge-Based Authentication (KBA): This method asks signers to answer "out-of-wallet" questions based on their personal credit history, like identifying a previous address or loan provider.

2. Capture Clear Consent to Do Business Electronically

This is a cornerstone of e-signature law: all parties must knowingly agree to use electronic records and signatures. You can't just assume they’re okay with it or force them into a digital workflow. Their consent has to be explicit, and you need to capture it before they sign anything.

A simple checkbox with straightforward language is the gold standard here.

Make sure your workflow includes a clear statement like, "By checking this box, I agree to receive, review, and electronically sign these documents." This is a non-negotiable step that must be recorded.

This small click carries huge legal weight. It prevents someone from later claiming they didn't realize they were entering into a formal, binding digital agreement.

3. Maintain a Tamper-Evident Audit Trail

If you have one piece of evidence to prove a signature’s validity, it’s the audit trail. This is the digital "black box" that records every single action taken during the signing ceremony. A rock-solid audit trail is what makes an e-signature legally defensible, providing undeniable proof of the entire process from start to finish.

A good e-signature platform will automatically capture key events, including:

- The exact time the document was created and sent out.

- The email and IP address of every person who viewed it.

- Timestamps showing when each party gave their consent to sign electronically.

- The precise moment the signature was applied.

- All post-signing activity, like when the final document was delivered.

This detailed log turns a simple signature into a fully documented legal event. If you need a refresher on the basics, our guide on how to create an e-signature provides a practical walkthrough to get you started.

4. Ensure Secure Storage and Accessibility

Your job isn't done the moment the document is signed. Laws like ESIGN and UETA require that the final, executed contract remains accessible to all parties. The signed document must be stored securely and be reproducible as a perfect, unaltered copy for its entire legal lifespan.

This means you need a system that doesn’t just store the PDF, but also protects its integrity. Choose a platform that offers secure, encrypted, long-term storage. You need to be confident you can produce an exact copy of the agreement at a moment's notice, whether it’s for an internal audit or a legal challenge years down the road.

Common Questions About E-Signature Laws

Once you get a handle on the basic rules, the real questions start popping up. How do these laws actually apply to the documents you use every day? Let's walk through some of the most common scenarios and questions we see from businesses trying to navigate e-signature compliance.

Think of this as the practical, "what-if" section that bridges the gap between legal theory and your daily workflow.

Are "Click-to-Sign" Agreements Actually Binding?

Yes, they almost always are. When someone clicks a button that says "I Agree," "Accept," or something similar, that action serves as their signature. It clearly shows their intent to sign, which is the core of what makes a signature valid.

The real test isn't the click itself, but the evidence you have to back it up. To make a "clickwrap" agreement stick, you need to be able to show a court that:

- The person had a fair chance to read the terms before clicking.

- They had to take a clear, positive step—like ticking a box and then clicking a button—to show they agreed.

- Your system can prove that specific person agreed to that exact version of the document.

This is why a robust audit trail is so important. Capturing details like the user's IP address, the precise time of the click, and the version of the terms they saw is what gives the agreement its legal muscle.

What's the Real Difference Between Electronic and Digital Signatures?

People mix these terms up all the time, but they aren't the same thing. Getting the distinction right is key to picking the right tool for the job.

An electronic signature is the broad legal idea. It’s any kind of electronic mark—a typed name, a scanned signature, even just a check in a box—that someone makes with the intention of signing a document.

A digital signature, however, is a very specific type of electronic signature. It’s the high-security version, using complex cryptography and a certificate-based digital ID to lock down the document. This process verifies who the signer is and creates a seal that shows if the document has been tampered with after signing.

So, think of it this way: all digital signatures are electronic signatures, but most electronic signatures don't have the heavy-duty security of a true digital signature.

Do I Really Need Special Software to Get a Legal E-Signature?

From a purely legal standpoint? No. From a practical one? Absolutely, yes.

You could, in theory, just paste an image of your signature onto a PDF and call it a day. The problem is, you'd have a nightmare trying to prove it was valid if it were ever challenged. How would you show who signed it, when they signed it, or that nobody changed the document after the fact? You couldn't.

This is exactly the problem that e-signature platforms were created to solve. They handle all the messy but crucial parts of the process for you, automatically:

- Capturing clear, undeniable consent from the signer.

- Helping to verify the signer’s identity.

- Creating a detailed, court-ready audit trail of the entire signing event.

- Sealing the final document to make it tamper-evident.

Using a reputable platform isn't just a best practice; it's the most straightforward way to ensure you're meeting all the legal requirements for electronic signatures.

How Long Do I Have to Keep E-Signature Records?

The rules for keeping electronically signed records are the same as for paper ones. E-signature laws didn't change any of the existing record-keeping requirements for things like tax documents, HR contracts, or client agreements.

The key thing to remember is that you must be able to pull up that signed electronic record and show an accurate copy of it for the entire required retention period. This means secure, reliable, and long-term digital storage isn't just a "nice-to-have"—it's a fundamental part of staying compliant.

Ready to meet all the legal requirements for electronic signatures with a platform designed for security and ease of use? QuickSign provides everything you need—from detailed, court-admissible audit trails to secure document storage—so you can get your agreements signed with confidence. Start streamlining your workflow today. https://quicksign.it